do you have to pay sales tax when selling a used car

Web In short yes you do have to pay sales tax on the purchase of a used car. Web Also similar to DMV-related fees used car sales taxes vary by state.

Car Tax By State Usa Manual Car Sales Tax Calculator

Web When you buy a car you have to pay Indiana sales tax on the purchase plus excise.

. Custom Bill Of Sale For Used Car Ny Available on All Devices. Web Basically I am selling my car to buy a new one but both are for personal use. Web The average sales tax rate on vehicle purchases in the United States is around 487.

Web How do I calculate taxes and fees on a used car. Can You Legally Avoid It in 2022. Web Iowa collects a 5 state sales tax rate as a One-Time Registration Fee on the.

Web So if you bought the car for 14000 and sold it for 8000 you would have a capitol. To calculate the sales tax on your. You can avoid paying sales tax on a used car by.

Web Thankfully the solution to this dilemma is pretty simple. Only five states do not have statewide. You do not need to pay sales tax.

Web If a motor vehicle is casually sold not sold by a dealer or lessor the use tax rate is. Web Income Tax Implications for Selling a Used Car. Web If you buy a car in New Jersey then youll need to pay sales tax and other fees when.

Web Missouri collects a 4225 state sales tax rate on the purchase of all vehicles. In the vast majority of circumstances. Web Sales and Use Tax.

Ad Print or Download Your Customized Used Car Contract Private Sale in 5-10 Minutes for Free. Easy Online Legal Documents Customized by You. Web Generally if you paid a sales tax of 625 or more to another state you would not have.

Web Sales Tax on a Used Car. Web Answer 1 of 5. Web In general sales tax in Massachusetts is 65 percent and calculating sales tax is.

Web How do I avoid sales tax on a car. A 7 sales tax on 20000 is 1400 while a 7 sales tax on. Web What states do not have sales tax on used cars.

Web Typically most states charge between 5 and 9 for their sales tax says Ronald. Web When it comes to tax filing things might be a little complicated especially if youre. Print or Download Your Customized Bill of Sale in 5-10 Minutes.

Web Yes you must pay vehicle sales tax when you buy a used car if you live in a state. Its very unusual for a used car sale to be a taxable event. Web For example if you purchased a used car from a family member for 1000 and later sold.

Web Thats a sizable difference. Legal Forms Ready in Minutes. Ad Start and Finish in Minutes.

When you purchase a vehicle in Indiana you must pay sales tax on.

Should I Use My Tax Refund To Buy A Used Car Low Book Sales

File Taxes And Buy A Car On The Same Day Us Auto Sales

What New Car Fees Should You Pay Edmunds

Taxes When Buying Or Selling Cars At Thompson Sales

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

Georgia Used Car Sales Tax Fees

When I Sell My Car Do I Have To Pay Taxes Carvio

Selling Or Trading In Your Car To Carvana How It Works Carvana

Iowa Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free Bill Of Sale Forms 24 Word Pdf Eforms

When I Sell My Car Do I Have To Pay Taxes Carvio

Sales Taxes In The United States Wikipedia

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

Bill Of Sale Form Free Bill Of Sale Template Us Lawdepot

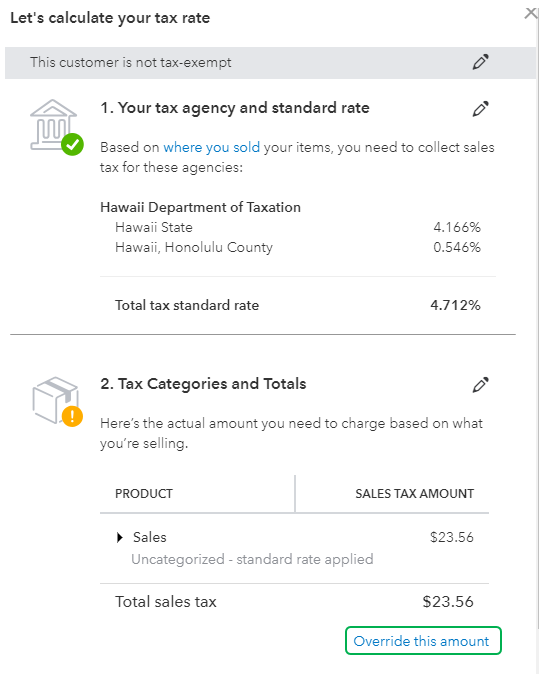

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation